MasterCard® Reward Debit | ATM Card

Discover the Convenience of a TopMark Rewards MasterCard® Debit Card.

Good wherever you see the MasterCard® logo. Use instead of cash for everything from groceries

to green fees, at thousands of merchants worldwide and, like, a gazillion places on the world wide web.

__________________________________________________________________________________________

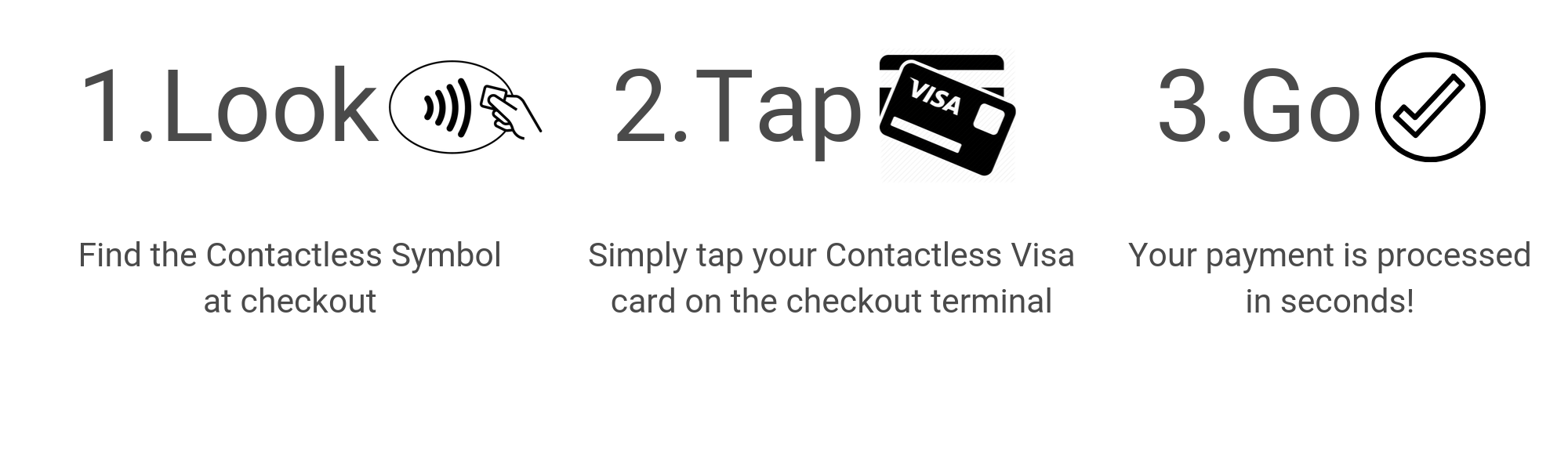

Contactless Card. Secure. Simple. Speedy.

What are the benefits of contactless payments?

Contactless payments are easy. Simply tap the contactless card on the contactless-enabled checkout. You'll find it's fast and convenient to use in places where you need to pay on the go. And, just like transactions made with a chip card, each contactless card transaction is accompanied by a one-time code that protects you and secures your transaction information.

How do I know if I can tap to pay with my TopMark VISA Card?

Look for the Contactless Indicator on your card to know if you can use tap to pay for purchases.

Do I actually have to tap my contactless card on the contactless-enabled terminal?No.

However, the card should be close (within 1-2 inches) to the Contactless Symbol located on the terminal.

Can I unknowingly make a purchase if I am in close proximity to a contactless-

enabled terminal?

No. Contactless technology requires the merchant to first initiate the payment and then the card must be within close proximity to the terminal for the transaction to take place. The terminal reads the card best when its flat over the Contactless Symbol, versus holding it at an angle.

ScoreCard Rewards is a rewards program offering Points for qualifying purchases.

When you make purchases with your TopMark Rewards Visa® Credit Card and TopMark Rewards Mastercard® Debit Card, you will be awarded points that can be redeemed on merchandise, travel, games and more.

All TopMark Debit Card and Credit Card users are automatically enrolled. You can also combine your TopMark FCU Debit Card and Rewards VISA Credit Card into one ScoreCard® account to maximize your point earnings.

______________________________________________

The Difference Between Selecting Credit vs Debit

at the Checkout

Self-check, Fast Lane, or Register 4? Insert or Swipe? Credit or Debit? All of these questions play a role in our shopping experiences each day. We don’t think about them much, but as times change and technology continues to advance, we will continuously be faced with new payment options and methods as consumers.

Choosing credit gives you more security on purchases

Most reputable card processors won’t hold you liable for unauthorized credit transactions. If you enter your PIN and fraud occurs, you’ll have to work out a solution with TopMark (or other financial institution) and wait before you get your money back.

Many card processors have zero-liability policies in place when you run your debit card as credit and treat your debit card just like a regular credit card when you make a credit transaction. If an unauthorized charge is made, it will refund all of your money back.

There are Two Huge Issues when you Select “Debit”

- You have entered your ATM PIN to an unknown (and often poorly-protected) point-of-sale computer.

- Money is immediately transferred from your checking account and you are responsible for any fraud.

Thieves stole 4 million transactions from Targe stores apparently swiping data over the network directly from cash registers. This allowed them to clone all of the cards, regardless of whether they were credit cards, traditional debit cards, or credit-logo debit cards. They definitely swiped PINs used for debit transactions, and they may have swiped lots more information, including card verification codes and personal information.

______________________________________________________________________________________

Additional Options

If ever you need to report your Debit MasterCard® lost or stolen, please call 1-888-918-7848 to report the loss and immediately block your card. We recommend you let us know when you plan to travel outside the U.S. so your card access isn’t interrupted.

Due to rising fraud trends, we have put restrictions in place on certain transaction types in order to protect you and the Credit Union. If your transaction will not process as a credit, try processing it as a debit by using your PIN number. Call us at with any questions!

Click Here to View our MasterCard Debit Card Agreement and Disclosure Statement.

* Current Balance or Balance and Available Balance" There are many circumstances that will affect your access to the funds in your accounts. Many of these transactions are beyond the Credit Union's control as they are requirements of the payment networks that your transactions are processed through via the merchants with whom you choose to do business. Also, we may place holds on various deposits as explained in the Funds Availability Policy Disclosure and under certain circumstances explained. Thus, your account records may show a "Current Balance/Balance" and an "Available Balance". The Current Balance/Balance is the total amount of funds in your account(s). The available balance is the current balance/balance. If you exceed the current balance/balance (even though the available balance may be greater) you may overdraw your account. This may result in insufficient funds transactions, returned items and fees including overdraft fees as a result of exceeding your current balance/balance. To know your current and/or available balance you may check online banking. Also, be sure you understand the order in which you transaction are paid so that you may avoid making transactions that exceed your current balance.