SecurLOCK Equip FAQs

Q: What is SecurLOCK Equip?

A:SecurLOCKTM Equip is a free mobile app that lets you control the security settings on your TopMark Mastercard® Debit Card and your TopMark Rewards VISA® credit card. You can customize usage restrictions, manage and monitor transaction activity, and receive instant notifications whenever your card is used.

Q: What do I need to use SecurLOCK Equip?

A:All you need is a TopMark FCU credit or debit card and the SecurLOCK Equip mobile app on your iPhone or Android smartphone. Once you register your TopMark FCU card in the app, you can begin customizing your card’s security settings. SecurLOCK Equip works with both personal and business cards.

SecurLOCK™ Equip Features:

- Receive instant transaction alerts

- View recent transactions

- Set your debit card Inactive if lost or Active when found

- Set spending channels Active or Inactive (in-store, online, mobile or ATM)

- Set transaction spend limits

- Set locations where the card can be used

Monitor Spending, Prevent Fraud, More Control

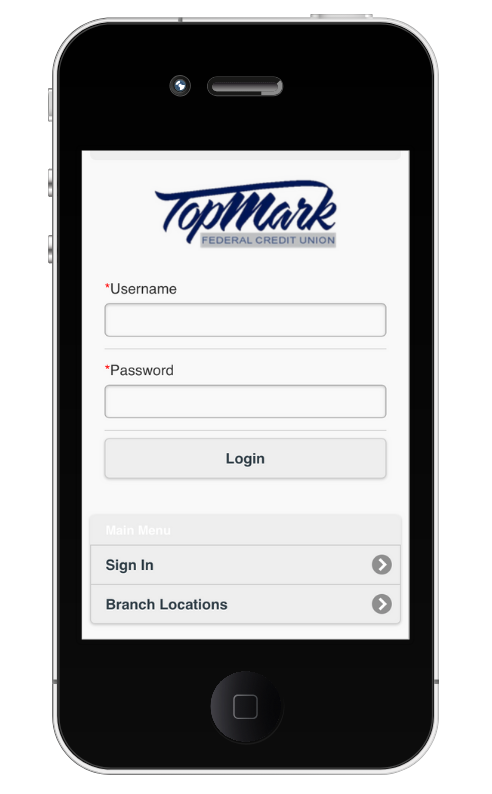

Download SecurLOCK™ on your mobile device today for free from the App Store or the Google Play Store.

Q: How do I register my credit card with SecurLOCK Equip?

A:Registration only takes a minute. Once you’ve downloaded the app, tap it to begin. A screen will appear that will ask for the credentials for your card. Type in the card number and hit the “Next” button. Next, type in the CVC number from the back of the card. Then, type in the expiration date of the card. At the bottom of the screen, it will ask for your billing address. Hit the “Next” button again.

Q: How do I use SecurLOCK Equip?

A:You can begin using it immediately. Practice by turning your card off and on. The green button in the top right corner of the card image will turn to red. This means that all transactions (excpect for recurring) will be declined. Turn the card back on, and the button turns green again. It’s that easy to turn your card off and on. Now you have the ultimate control to combat fraud.

Q: Does SecurLOCK Equip control all the security settings on my card?

A:The features of SecurLOCK Equip add another layer of security on top of the credit union's ongoing fraud monitoring service. In cases where the settings of the credit union's

fraud monitoring service and SecurLOCK Equip differ, the more restrictive setting will take precedence. This means that certain transactions outside your geography may still be declined even if your SecurLOCK Equip settings do not prohibit them. Please continue to contact us before traveling, so that we may place a travel alert on your credit card.

Q: I received a new card number. Will it be automatically updated in the app?

A:You will have to add the new account to the app. This can be done by going to Manage Account and adding the card. Be sure to “unmanage” the old card.